|

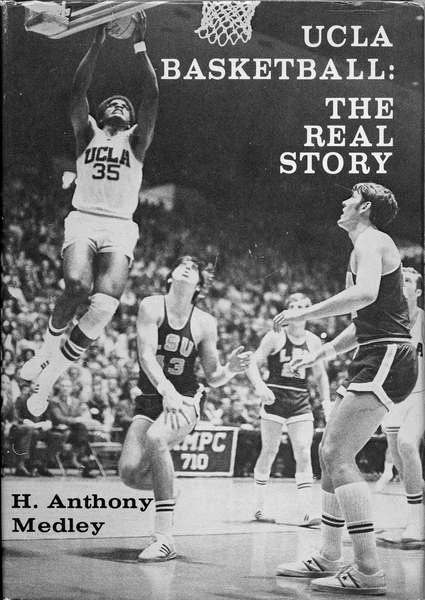

Out of print for more than 30 years, now available for the first time as an eBook, this is the controversial story of John Wooden's first 25 years and first 8 NCAA Championships as UCLA Head Basketball Coach. This is the only book that gives a true picture of the character of John Wooden and the influence of his assistant, Jerry Norman, whose contributions Wooden ignored and tried to bury. Compiled with more than 40 hours of interviews with Coach Wooden, learn about the man behind the coach. The players tell their their stories in their own words. This is the book that UCLA Athletic Director J.D. Morgan tried to ban. Click the book to read the first chapter and for ordering information. Also available on Kindle. |

|

Margin Call (9/10) by Tony Medley Run time 107 minutes. Not for children. I don't know if it is just me, but recently I have enjoyed the performances by the actors more than I have enjoyed the actual movies. The Ides of March was a pretty good movie, made exceptional by the performances of Philip Seymour Hoffman and Paul Giamatti. Drive was a run of the mill film filled with gothic violence that was set apart by Ryan Gosling's performance. Now comes Margin Call, which is a pretty good fiction about the financial meltdown in 2008. What makes it must-see viewing are the performances of Kevin Spacey, Jeremy Irons, and Simon Baker. This stellar cast faces financial devastation in this tense drama written and directed by J. C. Chandor. As Eric Dale (Stanley Tucci) is fired and being escorted out of the building, he hands a flash drive to Peter Sullivan (Zachary Quinto), an entry-level analyst, and tells him to "be careful." When Peter puts the drive into his computer and runs a few numbers, he is astonished to see that his huge firm is basically bankrupt, or will be very shortly if the projections on the flash drive come to pass. He tells his boss, Will Emerson (Paul Bettany), who escalates it to the power in the firm, Sam Rogers (Spacey), who tells his boss, Jared Cohen (Baker), who finally has to call in the big boss, John Tuld (Irons). The film covers the next 24 hours as these people meet to try to figure out how to confront the coming disaster. What this film indicts is the hypocrisy of Wall Street, exposing financial firms for what they are, salespeople. Nobody in the upper echelons of the firm understands the problem or can even explain what they do or how they make their money. The film is unclear about what exactly it is that they do, but apparently they have bundled mortgages and sold them to clients. What they are probably talking about are CDOs (Collateralized Debt Obligations) that represented bundles of mortgage bonds which were themselves bundles of home loans. The securities were supposed to be diversified so that if some homeowners stopped paying their bills, other loans inside the securities would be unlikely to default at the same time. But many of those securities turned out to be full of poorly underwritten mortgages that defaulted at the same time. I've seen two of the actors, Spacey and Baker, interviewed. They were asked what the movie was about, what the company in the movie did, and what caused the problem. They were clueless, which doesn't set them apart from the vast majority of the populace. Unfortunately, the Mainstream Media hasn't explained it, probably because it would kill its sacred cows on the left, like Barney Frank and Chris Dodd, who were personally responsible for the crises (by making the government finance the purchase of homes by people who couldn't afford them) and what happened, aided and abetted by Bill Clinton and George Bush. When the mortgage bubble bursts, the values of the CMOs go down to nothing, which is happening as they meet, and their billion dollar firm is worth nothing. What to do? Shot at 1 Penn Plaza in the offices of a firm that went under, the movie attempts to show these people as human beings and how decisions were made. This brings out the basic tartuffery of sellers of financial instruments. As the movie shows, the people selling these things are salesmen. Nobody knows anything about what they are selling. There is a telling dialogue between Spacey and Irons that sets the tone of the movie. When Irons demands that they sell everything they have, Spacey objects because, he says, they know that what they will be selling is worthless. Irons: "We are selling to willing buyers at the current fair market price so that we may SURVIVE." Spacey: "We may never sell to any of those people again." Irons: "I understand." Spacey: "Do you." Irons: "Do YOU?" October 19, 2011 |

|

|