|

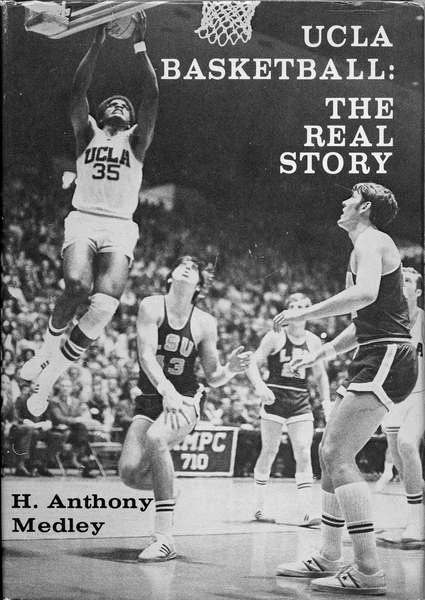

Out of print for more than 30 years, now available for the first time as an eBook, this is the controversial story of John Wooden's first 25 years and first 8 NCAA Championships as UCLA Head Basketball Coach. Notre Dame Coach Digger Phelps said, "I used this book as an inspiration for the biggest win of my career when we ended UCLA's all-time 88-game winning streak in 1974." Compiled with more than 40 hours of interviews with Coach Wooden, learn about the man behind the coach. Click the Book to read the players telling their stories in their own words. This is the book that UCLA Athletic Director J.D. Morgan tried to ban. Click the book to read the first chapter and for ordering information. |

|

Los Angeles County Proposition R November 2008 by Tony Medley

Before you vote for LA County

Proposition R, read the following from Bill Leonard, Member of the

State Board of Equalization:

For decades, California had a uniform sales

tax rate so consumers would not be surprised by different levels of

taxation when crossing a county or city line. The Bradley-Burns

Uniform Local Tax Law is still on the books but it has been so

grossly violated, it is now pretty much meaningless.

Through special legislation, cities and counties can now fund services through local voter-approved sales taxes. These are levied both on a countywide basis and within many incorporated city limits. Since the first local sales tax was approved by voters in 1970 for the Bay Area Rapid Transit District, we now have close to 100 of these special tax jurisdictions statewide. At first only county governments were authorized to levy the sales tax, but in 1991, special legislation allowed the city of Calexico to impose a city sales tax. Since then, an additional 22 cities, through special legislation, also gained authorization to put sales taxes on the ballot. In 2003 the Legislature opened the door for all cities to impose sales taxes, and the number of voter approved city sales taxes has exploded. There are now 62 city sales taxes, add these to the 36 sales taxes levied in counties, California currently has 98 voter-approved sales taxes. As local governments seek more tax revenue, more is expected. For the November 2008 General Election, there are at least 25 measures slated. In June, the city of South Gate in Los Angeles County voted to make the total sales tax there 9.25%. Also in Los Angeles County, on their November ballot is a measure that would allow the Los Angeles Metropolitan Transportation District to levy an additional half a percent sales tax throughout the county. Therefore, in LA County, a 9.75% sales tax rate is now likely. Folks, there is basically no real limit how high these taxes are going to go. As consumers, I urge you to look up the sale tax rate in your community before making a large purchase. Some localities have held their sales tax to the state base rate of 7.25%. Two and a half percent on a $30,000 car purchase would save you $750. The total sales tax rates for cities and counties can be found here: http://www.boe.ca.gov/cgi-bin/rates.cgi Here is a chart illustrating the explosion of these local taxes. http://www.boe.ca.gov/leonard/2009%20-Emerging%20Issues%208.pdf

|

|

|