|

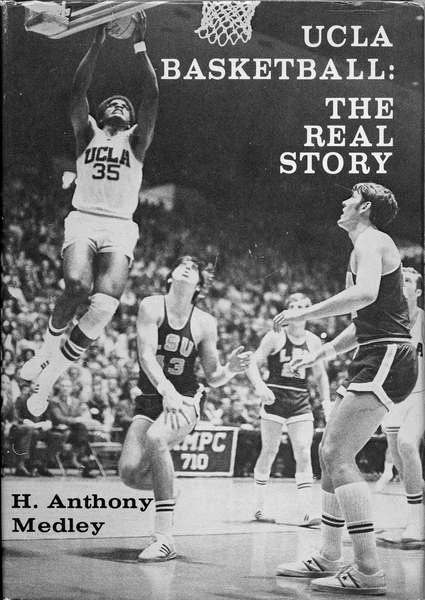

Out of print for more than 30 years, now available for the first time as an eBook, this is the controversial story of John Wooden's first 25 years and first 8 NCAA Championships as UCLA Head Basketball Coach. This is the only book that gives a true picture of the character of John Wooden and the influence of his assistant, Jerry Norman, whose contributions Wooden ignored and tried to bury. Compiled with more than 40 hours of interviews with Coach Wooden, learn about the man behind the coach. The players tell their stories in their own words. Click the book to read the first chapter and for ordering information. Also available on Kindle. |

|

Thumbnails Jun 24 by Tony Medley Unfrosted (9/10): 93 minutes. Netflix. PG-13. Jerry Seinfeld’s first foray into directing (he has a co-writing credit with Spike Feresten and Andy Robin) at age 70 is a booming success. This is a sparkling satire based on Kellogg’s and Post’s race to develop a new cereal, that became Pop-Tarts. It’s got a topflight cast. In addition to Seinfeld, there are Melissa McCarthy who is as funny as she’s ever been, and Hugh Grant, who sparkles like he always does, and Amy Schumer, along with a plethora of cameos by people like Peter Dinklage, John Hamm, Jim Gaffigan, the list goes on. It is exactly the kind of light-hearted, funny film we need in today’s world to give us an hour and half of fun. A Man in Full (9/10): 6 45-minute episodes. Netflix. TV-MA. This is a multi-faceted tale, based on Tom Wolfe’s 1999 novel about a real estate mogul, Charlie Croker (Jeff Daniels), in big trouble. He is attacked by his banker, Harry Zale (Bill Camp) who claims he owes the bank hundreds of millions of dollars. Zale is aided by Charlie’s former employee Ramone Peepgrass (Tim Pelphrey) and eventually joined by Charlie’s former wife, Martha (Diane Lane). Thrown in is a B story involving Roger White (Ami Ameen), the black husband of Charlie’s black secretary Henrietta (Jerrika), who is thrown in jail for assaulting a traffic cop, even though the cop was assaulting him. He is defended by Charlie’s attorney, Conrad Hensley (Jon Michael Hill), even though Conrad is a corporate lawyer. They get a judge, Judge Taylor (Anthony Heald), who appears to be as biased as the day is long. I mention these characters because they all give award-quality performances throughout this involving tale. Finding the Money (8/10): 95 Minutes. Prime Video. NR. As the fly said when it walked across the mirror, I never looked at it like that before. This is a paean to Modern Monetary Theory (MMT). Its John the Baptist figure is Stephanie Kelton, who is called “an American heterodox economist, an advisor to Senator Bernie Sanders.” In ordinary language, heterodox means heretical. The argument here is that everyone is looking at the deficit wrongly. What one draws from their argument is that the larger the amount of what we call the “deficit,” the better for us. Kelton and her many cohorts interviewed here proclaim that the “deficit” should be called an asset. When we sell bonds to China, she says, that’s good and the “debt” is really an asset. They say that all the deficit is, is that the government is putting more money into the economy than it’s taking out. If the government puts $100 into the economy and taxes 90% of it out, that’s a deficit for the government, but a surplus for the economy. Produced and directed by Maren Poitras, there are lots of interesting seemingly sacrilegious discussions about what money is and how it has worked throughout the ages. L. Randall Wray, a professor of economics, says that when money comes back to the issuer, it is destroyed. It’s been that way for all time. When taxes were paid in the Middle Ages in England, they were paid in tally sticks. When the tally sticks were returned as payment of taxes, they were burned. He claims that when money is repaid to the government, it is burned. I’m not sure if he is speaking metaphorically. One of the best parts of the film is when Kelton interviews Jared Bernstein, Chair of the Council of Economic Advisors under President Joe Biden. Following is an unedited transcript of how he stammers and mutters after Kelton asks him a simple question. This guy clearly seems to be in way over his head: “KeltonLW)hy exactly are we borrowing in a currency that we print ourselves? I'm waiting for someone to stand up and say, why don't we borrow our own currency in the first place? “Bernstein: “Well… “The… “So the… I mean… “Again, some of this stuff gets… “Some of the language that the… “some of the language and concepts are just confusing. I mean the government definitely prints money, and it definitely lends that money, which is why the government definitely prints money and then it lends that money by… by selling bonds. Is that what they do? “They, they… “They yeah, they, they. They sell bonds. Yeah, they sell bonds. Right? Since they sell bonds and people buy the bonds and lend them the money. Yeah. So… “A lot of time, a lot of times, at least to my year with with MMT, the the language and the concepts can be of unnecessarily confusing. But there is no question that the government prints money and then it uses that money to… “So… so …the. “Yeah, they… they print money and they use that money to… “They sell bonds…they borrow. “Yeah… I… I guess I'm just… I don't… I can't really talk...I don't… I don't get it. I don't know what they're talking about like, because it's like… “The government clearly prints money and does it all the time, and it clearly borrows. “Otherwise we wouldn't be having this this conversation. So I don't think there's anything confusing…There..”. Just watching this guy in powerful position, sounding like Kamala Harris, squirm and mumble is worth the price of admission. They gave a glimpse of their true colors at the end when the thrust of their goal is advocating for taxing the rich to pay their “fair share” and income distribution. However, the data for 2021 shows that the top 1 percent of earners, defined as those with incomes over $682,577, paid nearly 46 percent of all income taxes. The top 25% paid 89.2% of all taxes. The bottom 50% paid under 2%. I’m not sure how they define “fair share.” Even so, I recommend this because their discussions and arguments are interesting and thought-provoking, and their slant on the use of money enlightening if what they say is accurate. Or is it nonsense? Recommended Reading: “The Fury” by Alex Michaelides, a diverting mystery.

|

|

|