|

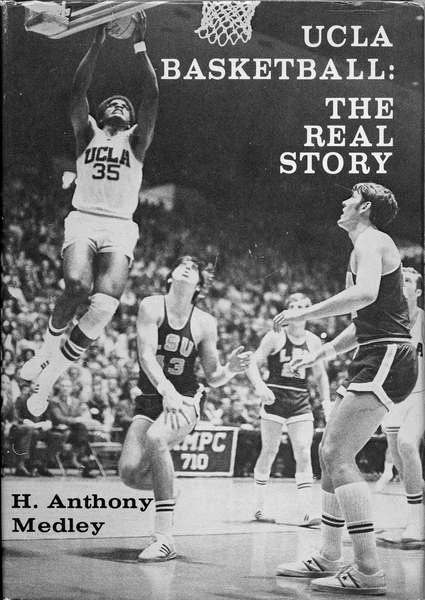

Out of print for more than 30 years, now available for the first time as an eBook, this is the controversial story of John Wooden's first 25 years and first 8 NCAA Championships as UCLA Head Basketball Coach. This is the only book that gives a true picture of the character of John Wooden and the influence of his assistant, Jerry Norman, whose contributions Wooden ignored and tried to bury. Compiled with more than 40 hours of interviews with Coach Wooden, learn about the man behind the coach. The players tell their their stories in their own words. Click the book to read the first chapter and for ordering information. Also available on Kindle. |

|

The Wolf of Wall Street (6/10) by Tony Medley Runtime 180 minutes. Not for children. The weakness of our capitalistic system isnít in the means of production. The main weakness is in professional services, where there is almost always a built-in conflict of interest. The most morally corrupt in our society is without question the legal profession where lawyersí primary interest in billing as many hours as possible is clearly in conflict with their obligation to do good for their clients. But the horrible moral compass created by this conflict of interest isnít limited to lawyers. All providers of personal services have to compromise between maximizing profit and doing what is best for the client. Stock brokers are probably as close to lawyers as being the low people on the totem pole as any other personal service. Finally here comes a film that castigates the lack of integrity of the stock brokerage profession and calls a spade a spade. While there are good, moral stock brokers, just as there are good, moral lawyers (somewhere; just donít ask me where they are) there are many more who are in it for what they can get out of it, not to do good for the client. This presents a moral and ethical roadblock that is almost impossible to surmount. Many, if not most, stock brokers donít know what is a good stock investment and what isnít. If they were that smart theyíd be investing for themselves and not just working to live off the commissions they receive on trades. What a stock broker wants to do is get the highest commission on his trades, forget whether or not the trade ends up being profitable for the client, and to ďchurn,Ē make as many trades as possible. As a result he recommends any stock for which he can come up with a plausible reason to buy, whether itís accurate or not. Thatís what this movie exposes. Leonardo DiCaprio plays Jordan Belfort, a real life person who told his story in a frank memoir that director Martin Scorsese has made into a movie, seeming to go overboard in showing the moral corruption, not just in the broker-client relationship, but in all things, as Jordan and his fellow brokers wallow in drugs, exorbitant spending, rampant infidelity, and sexual excess. Jordan is a salesman who doesnít have a clue about what is or what is not a good investment. But he does know where the money is after heís advised what the game is at the outset by Matthew McConaughey. In essence, heís told to get the money for himself, as much as he can and as fast as he can at the expense of gullible investors who know less about investing than Jordan does. Jordan learns this lesson well, establishes a stock brokerage full of brokers with no sense of ethics trading penny stocks, and makes an obscene fortune for himself and his brokers. This film at times brings to mind such movieland bacchanalia and orgiastic rites as Gore Vidalís Caligula (1979, produced by Penthouse Magazine's Bob Guccione) that contained rampant nudity and graphic sexual acts. Scorsese stops short of making this a hard core pornographic film, but there is abundant nudity including multiple scenes of people simulating sex. Is watching Leonardo Dicaprio simulating innumerable graphic sexual acts entertaining? Not to me. But Scorsese submits his audience to this time and again. I said that Scorsese ďseems to go overboardĒ but apparently this is the way it was. Itís hard to believe that people really acted (or still act) this way, but apparently Scorsese is just showing Jordanís life as he and his cohorts lived it. But the biggest weakness of the film is that it totally ignores the clients who are taken to the cleaners by these unethical brokers. People lose real money and lots of people lost a lot of real money to these people, but Scorsese and DiCaprio apparently donít think they are important enough to even mention. We donít even see as much as one person who invested money with these creeps and lost it all! In three hours Scorsese couldnít find the time to show the effects of what these brokers did on the innocent victims? Thatís inexcusable and superficial movie-making. Even though itís apparently factually accurate, and while it justifiably indicts the dishonesty and hypocrisy pervasive in the stock broker profession, to sit through three sensationalized hours of all this debauchery is just too much.

|

|

|